05.05.15

Apolitical, long-term housing strategy needed – KPMG

With the gap between house prices and wages still growing, the next government needs an apolitical, long-term housing strategy, engaging both public and private sectors, research from KPMG has reiterated.

The company says the next government must do more to unlock public sector ‘land banks’ – surplus land that could be used for housing.

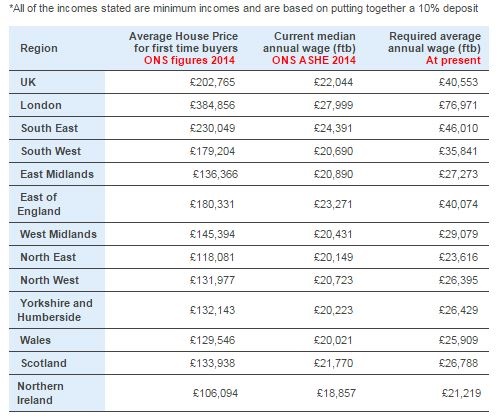

Its latest research revealed that the UK-wide annual wage needed to get on the property ladder is £40,553, against the actual median annual wage of £22,044. These figures are based on a 10% deposit and borrowing the remaining 90% at a loan to income ratio of 4.5.

The study highlighted that there is a significant gap in every UK region between the actual and required wages needed, creating an environment where only those earning over the average can afford to buy.

A KPMG-commissioned poll of 10,000 people also revealed that some 69% of people feel there is not enough housing in the UK that is affordable, with 30% concerned about how they will afford or continue to afford their own home or pay their rent.

Jan Crosby, head of housing at KPMG, said: “These figures make for frightening reading and show that housing affordability is no longer just a problem for lower wage earners. Now unless you earn well above average or receive an inheritance, it is unlikely you will be afford to buy, no matter where in the UK you live.

“And yet this isn’t just about home ownership, because our findings show genuine concern over wider affordability of housing, whether buying or renting.”

Last year, KPMG and Shelter published a blueprint for the next government to tackle the housing crisis. It included recommendations to give local authorities the power to designate new homes Zones on strategic sites, which, like enterprise Zones, would foster low cost development and growth.

On top of this, there were calls for increasing public and private investment in housing associations, so that they can build more homes and especially more low rent social homes.

A more radical approach also included introducing a new not-for-profit housing Investment Bank funded by personal savings IsAs guaranteed by government to provide steady returns. The Investment Bank could then provide low-cost, long-term loans to affordable home providers.

Crosby added that politicians need to develop an “apolitical, long-term housing strategy, engaging both the public and private sectors, to get the UK building and stabilise our housing market”.

She stated that reforms “must be widespread” further unlocking public sector land banks, boosting small and self-builders, giving power to towns and cities to build the homes they need, and increasing investment in affordable homes.

As the general election is fast approaching, Crosby said: “We again call on the next government to act decisively on housing so that people’s basic housing needs and their longer-term aspirations can be met, whatever they might be.”

In March this year, more than 2,000 people joined the ‘Homes for Britain’ rally in the heart of Westminster to call on politicians to end the country’s housing crisis within a generation.

On top of this, the Local Government Association is to work with the government to develop a privately-funded national Housing Finance Institute in an attempt to tackle the country’s overall shortage in housing supply.

The Institute, which had been proposed by the Elphicke-House review, will attempt to address the skills and knowledge gap in delivering local authority housing.

Tell us what you think – have your say below or email [email protected]