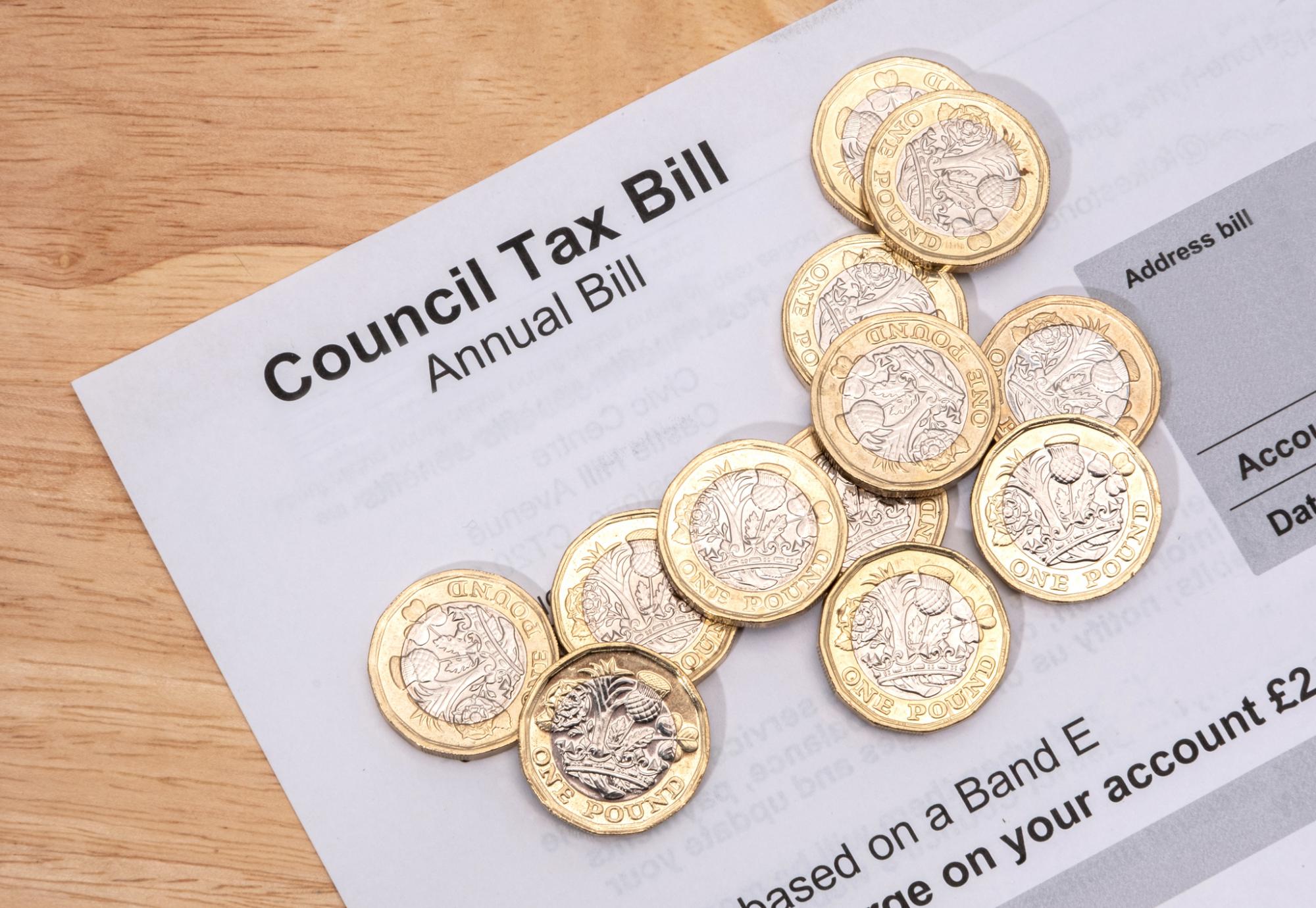

Rising numbers of families on low incomes face paying more council tax from April without an extension to one-off government funding for local council tax support schemes, the Local Government Association (LGA) has warned.

Latest figures show more than 2.5 million working aged people across England claimed a discount on their council tax between April and June this year, which remains the highest number since records began in 2015.

The government has provided £670m to councils this financial year (2021/22) to help them provide discounts to households struggling to pay their council tax bills because of the pandemic.

With the ongoing economic fallout of Covid-19 likely to continue for some time, the LGA is calling on the Chancellor to use this month’s Spending Review to continue the grant for the next three years.

Without this extension, the LGA is warning that councils, facing significant existing and future spending pressures over the next few years, will be unable to provide council tax support to all those in need.

This could combine with the end of the Universal Credit uplift, other Covid-related support and rising bills to add to cost of living concerns for some of the most vulnerable.

The LGA’s Spending Review submission projects that councils in England face extra cost pressures of almost £8bn by 2024/25 just to keep vital local services running at today’s levels.

To illustrate the scale of these extra demand and cost pressures facing councils, the LGA projects that council tax income would need to rise by a quarter over the next three years to pay for them.

Since 2013, councils in England have been running their own local schemes to help economically vulnerable households with council tax bills after the national benefit was abolished.

However, the funding government has given to councils to fund these schemes reduced by around half, £2bn, between 2013 and 2020.

The LGA said this has increasingly left councils with an unpalatable choice between charging council tax to the working-age poor, who in many cases may not have paid council tax before, or diverting funding from under pressure services, such as adult and children’s social care, homelessness support and roads maintenance, to pay for discounts.

Local authorities have been at the forefront of providing support to economically vulnerable households throughout the pandemic.

As the country moves on, the LGA said the Spending Review also needs to provide an effective long-term solution to preventing poverty and disadvantage that moves away from providing crisis support towards improving life chances and building resilience.

According to the LGA, this is vital to levelling up and tackling the stark inequalities exposed by Covid-19.

Councils want to be able to work with households and communities to tackle the underlying causes of crisis and disadvantage, to reduce inequality and promote strong, integrated and economically enfranchised communities, the LGA said.

While the mainstream benefits system will need to provide the first line of support to those in need, the vital role of local government in supporting individuals and families in hardship must be appropriately recognised and adequately resourced, they added.

The LGA said the Spending Review also presents an ideal opportunity to fully restore core, separately identified funding of at least £250m each year for wider local welfare provision to ensure that all communities are fairly and effectively supported throughout recovery and beyond.

Commenting, Chair of the LGA’s Resources Board, Councillor Shaun Davies said:

“Councils know how tough things are for many low-income working households who are already concerned about potential income losses and the cost of living.

“Record numbers are claiming a discount on their council tax due to the pandemic and one-off government funding has been crucial to help councils provide vital support for those struggling to pay this year.

“No council wants to ask those on the lowest incomes to pay more. Faced with severe funding and demand pressures that continue to stretch local services to the limit, many councils will have little choice but to reduce discounts without an extension to this government grant beyond this year.

“The Spending Review needs to provide councils with the full amount of funding required to provide council tax support to those who need it over the next few years to avoid bills being forced up for those who can least afford to pay.”