25.11.15

Councils to keep asset sales receipts while mayors control business rates

In addition to retaining business rates, councils will be able to spend 100% of the receipts from the assets they sell in order to improve local services and reform projects.

Chancellor George Osborne, who announced the move during his Spending Review today, said further details of how this will work will be set out by the DCLG alongside the local government settlement in December.

But he has also announced that city-wide mayors, to be elected in 2017 as part of devolution deals, will have the power to levy a ‘business rates premium’ for local infrastructure projects. To raise these rates, they will need the support of the local business community through a majority of business members of their local enterprise partnership.

To encourage local authorities to sell surplus assets and reinvest them to make services more efficient, the government will strengthen the rights communities have to reclaim council land and property.

It will also consult on updating the Transparency Code to require all local authorities to record details of their land and property assets in a consistent way.

Another £31m will be used to extend the One Public Estate programme to support councils in designing more efficient asset management strategies.

And as part of his housing reforms, local authorities will receive £2.3bn in loans to regenerate their large estates in order to reinvest this money in new housing stock.

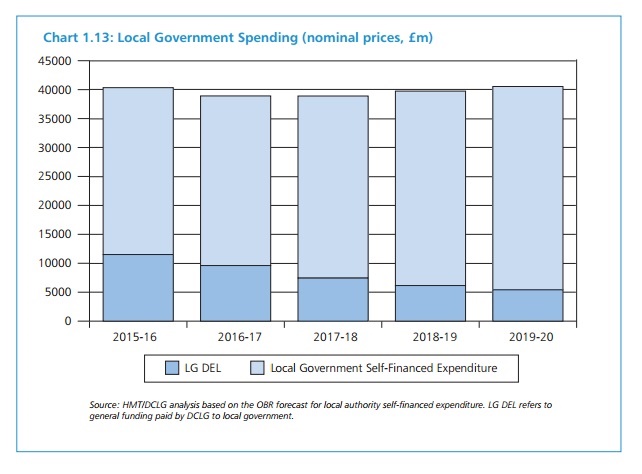

In contrast to these changes, Osborne has also vowed to phase out the revenue support grant councils receive from central government, although he claimed this represents less than one-quarter of their total resources.

Whitehall predicts that other sources of income, such as council tax and business rates, will grow by £6.3bn by 2019-20.

But Tony Armstrong, Locality chief executive, said cuts to this revenue grant, as well as public health, mean that “we are storing up problems in the future by not preventing or intervening at an early stage”.

And Simon Parker, director of the New Local Government Network, said that encouraging councils to sell property to fund services is an unsustainable move. Others echoed his views on social media by calling it a temporary source of income.

As part of the government’s consultation on changes to the local government finance system, additional responsibilities will also be devolved to councils, as local government minister Marcus Jones MP had previously suggested.

Whitehall will consider, for example, transferring responsibility for funding the administration of the housing benefit for pensioners, as well as consult on options for devolving public health budgets. It will consult on these and other responsibilities next year.

Responding to these announcements, LGA's chair, Lord Porter, said: “Today’s Spending Review has handed down a difficult £4.1bn funding cut over this Spending Review period for our residents, and comes on top of almost £10bn in further demand-led cost pressures facing councils by the end of the decade. The consequences for our local communities who will suffer as a result should not be underestimated.

“It is wrong that the services our local communities rely on will face deeper cuts than the rest of the public sector yet again and for local taxpayers to be left to pick up the bill for new government policies without any additional funding. These local services which people cherish will have to be drastically scaled back or lost altogether as councils are increasingly forced to do more with less and protect life and death services, such as caring for the elderly and protecting children, already buckling under growing demand.

“This Spending Review was never about just spending less, it was about spending smarter. Local government has led the way at finding innovative ways to save money, but after five years of doing so the majority of savings have already made. Tragically, the government looks set to miss a once in a generation opportunity to transform the way money is spent across the public sector and protect the services that bind communities together, improve people’s quality of life and protect the most vulnerable.”

But Lord Porter acknowledged that being able to retain 100% of business rates incomes would help councils mitigate some of the pressures they will face after deeper cuts.

"While it is positive that the Treasury has worked with us to localise business rates, this is just the start of the journey. We will continue to work closely with Greg Clark and the DCLG team on the detailed work and consideration that must go into what extra responsibilities councils should take on to ensure we get the best outcome for local communities,” he concluded.

Tiffany Cloynes, head of public services (England) for Geldards LLP, said: “In pursuing a revolution in the way the country is governed, the Chancellor has thrown the gauntlet down to local government giving them new opportunities to direct and influence what happens in their areas. There is real momentum behind devolution, both on the grand ‘powerhouse’ scale and on a smaller scale up and down the country. This combined with the chance to control business rates and use receipts from asset sales, subject to playing by certain rules, offers real opportunities.

"The challenge now is for councils, already straining to deliver services after successive years of spending cuts, to find the energy and resources to exploit the potential offered by the Spending Review. The conditions around business rates; the pressure to sell off land; the re-designation of unused commercial land and the push to release former public sector land for development underscore the need to work intelligently and more closely with the private sector to ensure the best outcome for services and for their areas generally.”