10.09.15

Millions of households’ earnings to drop despite living wage – IFS

Millions of unemployed households eligible for benefits or tax credits will see a drop of more than £2,000 in their yearly earnings due to benefit and tax credit cuts, with no offset ‘compensation’ from the new national living wage, the IFS has revealed.

The 8.4 million households also eligible for benefits that have at least one person in paid work will suffer £750 in cuts per year.

Among this group, the “better case scenario” of average gain from the national living wage is estimated at £200 per year – or £140 when scaled downwards to match estimates by the Office for Budget Responsibility.

A report by the IFS published today (10 September) showed that the best case scenario for those in paid work who are eligible for benefits is a return of 26% of their losses from changes to taxes, credits and benefits through the new national living wage.

It added that it is “clear” any compensation for those set to lose from cuts to benefits announced in the Summer Budget will be partial “at best”.

There will be £12.5bn of net cuts to benefits and tax credits and around £4bn of increase in gross wages.

The IFS says that although the living wage will increase hourly pay for some, it is “highly likely to reduce incomes in other ways” and slash employment.

The OBR assumes it will have the effect of increasing the unemployment rate by 0.2% (or 60,000 people) and reduce the average hours worked by those in work, as businesses make cuts to cover the costs of hourly pay rises. It also estimates GDP will be reduced by 0.1% after the living wage is introduced.

It also said that even if they considered a “favourable scenario” where GDP is left unchanged, the money to finance higher wages “will need to come from someone” – meaning the living wage would provide “only very partial compensation” to poor families.

“In other words, the OBR is expecting that the new national living wage will result in a small overall reduction in living standards, at least in the short run,” the report said.

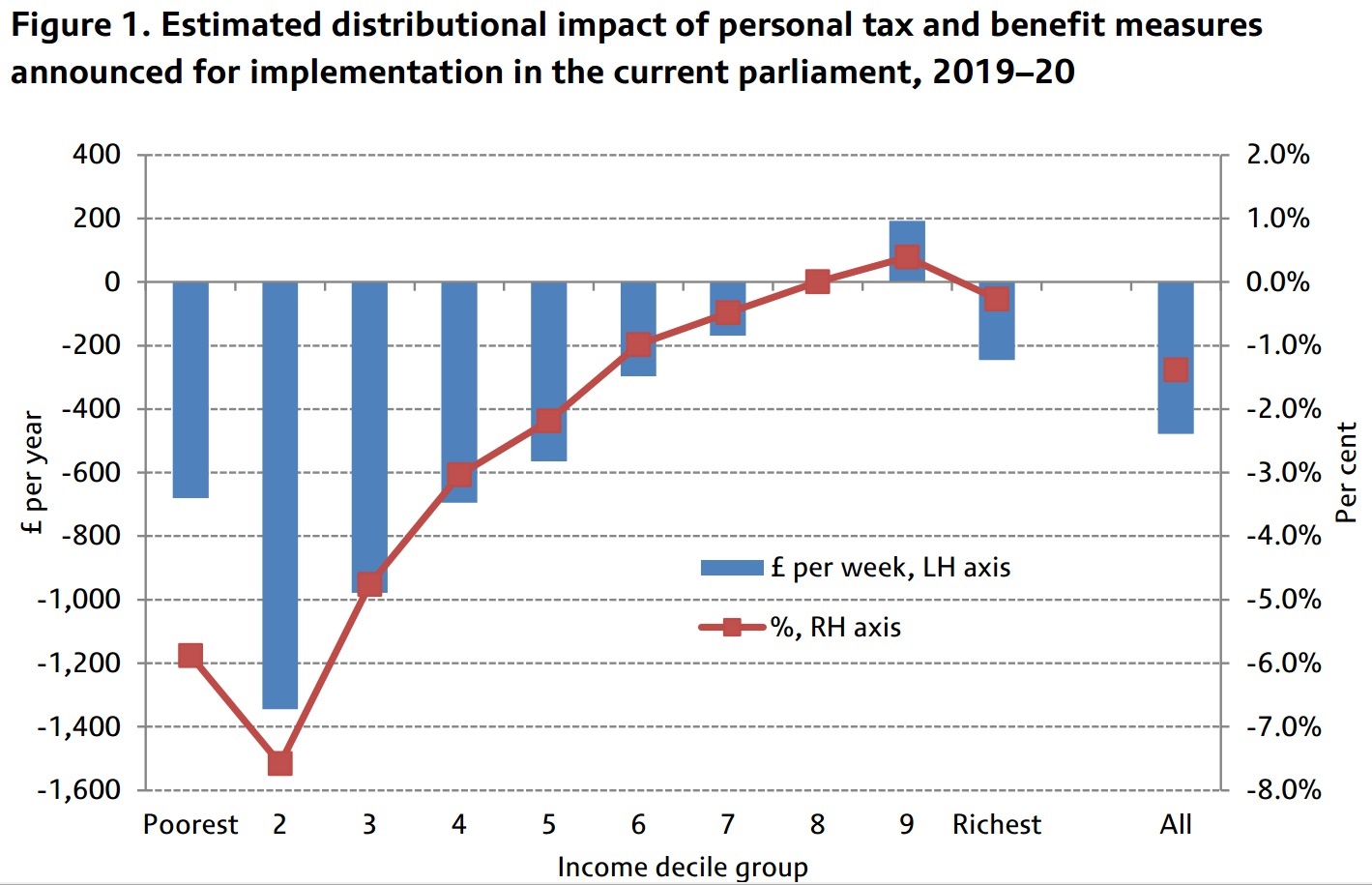

Overall the measures are estimated to reduce household incomes by an average of £480 per year, or 1.4% - but the average losses are not equally distributed.

According to the IFS, the poorest households will be hit the hardest as a result of cuts to working age benefits and tax credits.

While some of the poorest households are set to lose almost £1,400 per year, some of the richest households will gain almost £200. The very richest income decile will lose just over £200, but are set to benefit generally from both the tax and benefit changes and the new living wage, while the second richest decile is the only group to see a net gain per week (£200) from the impact of personal tax and benefit measures announced for implementation in the current Parliament, as at 2019–20.

The report concluded: “The national living wage is therefore not a substitute for targeted benefits and tax credits when it comes to helping poorer households and tackling poverty. In aggregate, it is not big enough. And it is not targeted at the same group.

“This does not mean it is necessarily a bad idea. It will provide some compensation to some of those hit by the benefit and tax credit changes. Moreover, if the government believes the labour market functions poorly and that some people are paid less than their productivity warrants, mandating higher pay through the new national living wage may help address this problem.”

It added that some argue the higher wages could prompt higher productivity – but IFS said it could have negative impacts on employment and hours of work, calling for a “crucial” need to carefully monitor the impact of the new wages.

Stephen Timms MP, Labour’s acting shadow work and pensions secretary, slammed the expected results from the tax credit cuts, calling it a “raid on the income of working families”.

He said: “Low and middle income families will bear the brunt of the Tories’ work penalty in the tax credit system announced in July’s Budget.

“With MPs set to vote next week on the tax credit cuts, it’s time for the Tories to come clean about how much working families will be worse off under their plans.”

Earlier in September, trade union Unison claimed thousands of low-income families will be progressively worse off from April, stating households would lose almost £2,000.

Unison general secretary, Dave Prentis, said at the time: “At first glance, low-paid workers might look quids in, but on closer inspection the chancellor is really rewarding them with an income cut. Many workers on the minimum wage will lose out as a result of the plans. It is dishonest for ministers to claim that people will be better off. They won’t.”

The union urged MPs to oppose changes to tax credits threshold and taper that will be laid out in Parliament between September and January.

The national minimum wage is set to rise from £6.50 to £67.0 an hour in October, and to £7.20 in April over 25s.