15.12.15

Calls for land and property tax devolution as Whitehall prepares 2016-17 settlement

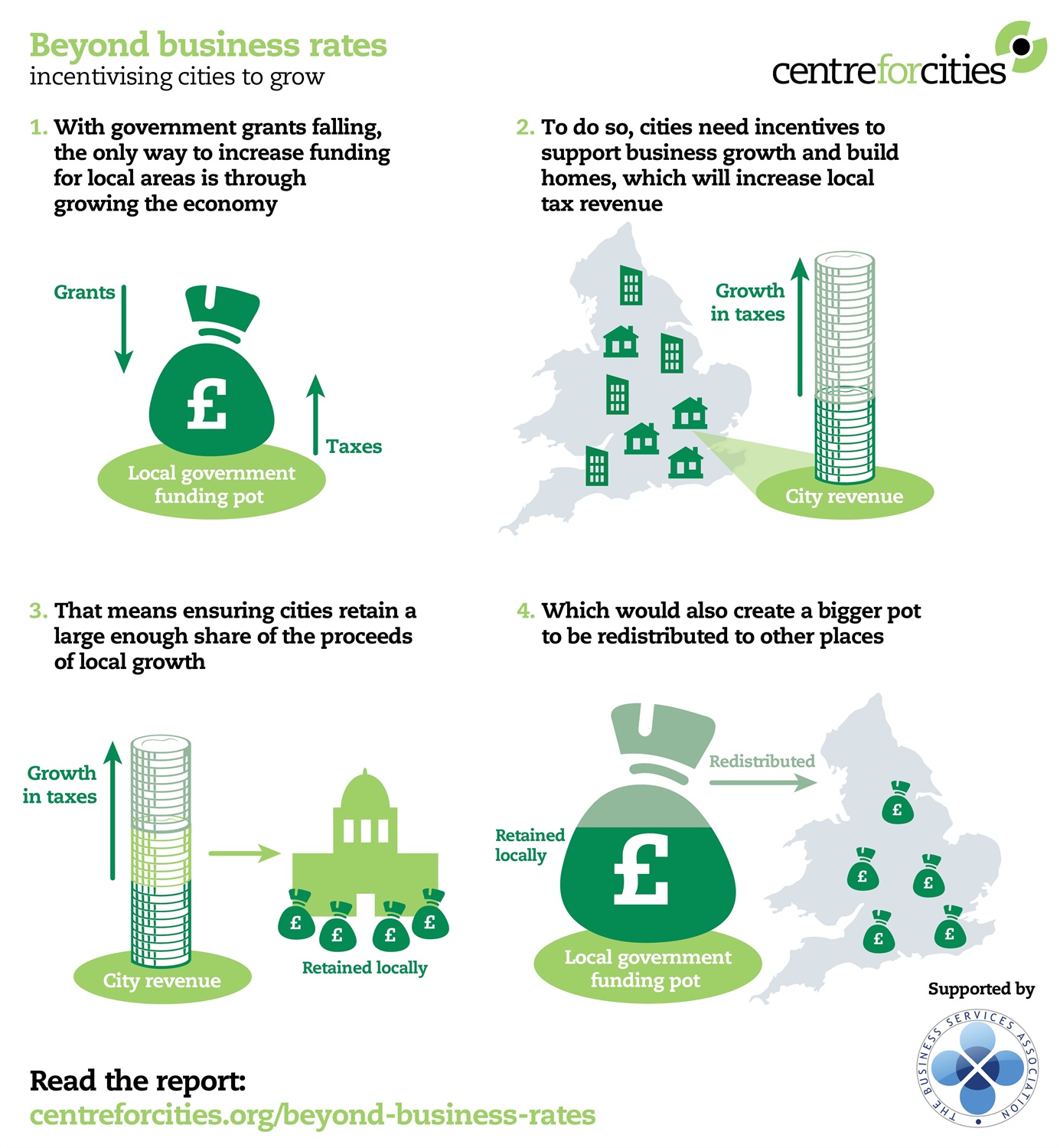

To create a sustainable system of local government funding, Whitehall must look into further devolving fiscal powers through land and property taxes and housing benefit, the Centre for Cities has argued in a report.

The think tank said that while devolving business rates is a welcome step, local leaders must be given more control over their finances to create stronger incentives to boost growth and widen the funding pot.

Part of this could take the shape of devolved stamp duty tax revenue, worth £10bn in 2014-15, or handing councils the responsibility for land and property taxes.

The latter proposal alone would give them control for 41% of their spending, compared to just 19% in the current system of funding – although this would still be relatively low in comparison with other countries. Local taxes account for 48% of spending in France, for example, and 64% in New York.

But the move, however low, would still help create incentives for regions to generate more revenue. The think tank’s report showed that while devolving land and property taxes can increase variation and disparities in revenues, it could also increase the size of the overall local government cash pot by giving places greater control over a growing tax base and encouraging cities with strong economies to grow sector. As a result, there would be more money in the sector to then be redistributed to places with weaker economies.

This could ultimately help solve the inequalities identified in a credit agency report published in October, which found that devolving business rates meant councils would only benefit from additional business rates revenue – given that the existent ones will be offset by a drop in main grant funding. This would then make councils more dependent on a less predictable form of income and spark inequalities between councils with different characteristics credit profiles.

Click on the image to enlarge it.

Click on the image to enlarge it.

Today’s report also highlighted a strong correlation between land and property taxes and other tax bases, such as income tax, meaning incentivising places to boost growth by devolving taxes could also generate more money for national finances.

If local government were motivated to achieve 1% growth in land and property taxes through devolution, for example, an extra £1bn could be generated annually in income tax.

Commenting on the findings, Centre for Cities chief executive, Alexandra Jones, said: “For places across the country to prosper in the coming years, local leaders must have the right financial powers and incentives to support growth in their local economies.

“With a new funding system in which places are expected to raise more revenue themselves, some will argue that the focus should be on redistribution from relatively prosperous areas to those with weaker economies.

“The government’s move to devolve business rates was an important step in the right direction, but doesn’t go far enough. Devolving land and property taxes would encourage places with weaker economies to develop their tax base, while also giving places with high economic demand more incentives to take the often difficult decisions needed to invest in infrastructure and new housing.”

Separately, during a Commons debate yesterday (14 December), communities secretary Greg Clark MP announced that he will shortly be presenting the local government financial settlement for 2016-17.

Local government minister Marcus Jones MP added later on that the government will press on with cutting local authorities off from central grants.

“In the provisional local government settlement that will come very shortly, we will announce changes to the local government finance system to rebalance support, including to those authorities with adult social care responsibilities, by taking into account the main resources available to councils, including council tax and business rates,” he said.