25.04.17

Employee financial wellbeing in the public sector

Source: PSE Apr/May 17

Charles Cotton, performance and reward adviser to the Chartered Institute of Personnel and Development (CIPD), analyses the financial wellbeing of those working in the public sector.

In 2016, the CIPD produced a report on employee wellbeing, showing the positive impact that this could have on organisations. Our publication also highlighted the significance of mental wellbeing and, within that, the importance of financial wellbeing.

This led to us commissioning research focused on employee financial wellbeing, looking at such issues as how we define it, what the consequences of poor financial wellbeing are and how stakeholders can act to improve it. In addition, we surveyed over 1,800 employees across the public and private sectors about what they thought of financial wellbeing, whether money worries had affected them at work and the barriers that they face in improving their financial situation.

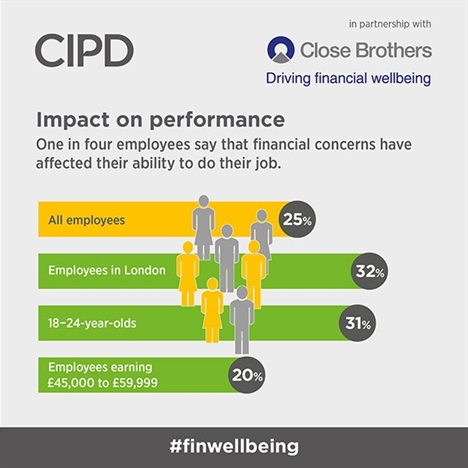

The survey found that 25% of those who responded say that money worries have impacted on their work performance. Certain groups of employees are more likely to report this. For instance, 32% of those working in London; probably associated with the higher costs associated with living, working or communicating in the capital.

It also revealed that 30% of public sector staff reported that money concerns have impacted on their work performance. This relatively high proportion may be a reflection of the 1% pay rise policy in the public sector since 2012, as wages have been squeezed in comparison to elsewhere. While the level of income is also a key factor, for example 28% earning less than £15,000 a year admit that money concerns have affected their ability to do their work, a surprisingly high number of those earning more also say that money worries have affected their job performance. For instance, 20% of those earning £45-£59,999 report their work performance suffering from financial worries.

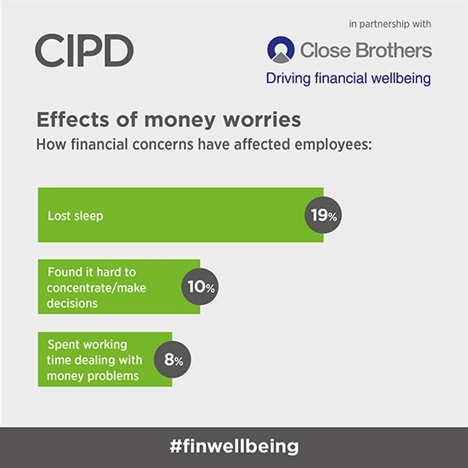

There is an interesting difference when we separate the public sector data in the survey. For example, we asked our sample about the ways in which money worries have affected their ability to do their jobs. The most common impact is physical fatigue caused by lost sleep worrying about money (19%), but this proportion is slightly higher in the public sector (22%).

Elsewhere, while 10% of employees report they found it hard to concentrate/make decisions at work because of money worries, this proportion increases to 15% in the public sector. Similarly, while 8% say that they have spent time during the working day dealing with money problems, this increases to 12% among public sector staff. We can only speculate about the reasons behind this, but the pay freeze mentioned earlier is likely to mean their pay has been squeezed to a greater degree than other sectors, and this is cascading down into greater money worries generally.

The key elements of financial wellbeing

We also asked employees which elements of financial wellbeing are important to them. We asked them to give us their top five choices. The most common element of financial wellbeing among our public sector sample is ‘earning a wage sufficient enough so that I and my family/loved ones enjoy a reasonable lifestyle’ (80%); again emphasising the focus on pay. They are also more likely to rate highly ‘being able to save for the future’ (63%) and ‘staff benefits that protect them and their family’ (39%), perhaps an indication of the changes to public sector pensions over the past decade. They also rate highly being ‘rewarded for my efforts in a fair and consistent manner’ (52%).

Public sector workers (66%) are more likely to claim that they face barriers in managing their financial situation than the average (58%). They are most likely to say this is due to: only earning enough money to get by each month (36%); the amount of hassle involved in saving money (19%); just finding the time to manage money (14%); and the difficulty in interpreting financial jargon (15%).

Our report shows that while the absolute amount of pay is important to employee financial wellbeing, so too is the relative amount. Those who perceive pay decisions aren’t made in a fair and consistent manner are more at risk of poor financial wellbeing. Employers should review their existing reward practices to see that they support employer and staff needs in a fair and consistent manner, as well as look at how these decisions are communicated throughout the organisation.

Debt is not necessarily a bad thing; what’s important is how well workers are able to manage and pay down that debt. Employers can play a role in helping their staff become financially savvy and responsible by helping employees make more informed choices and, therefore, preventing debt from becoming unmanageable for some workers – rather than having to deal with the consequences, such as through hardship loans.

The findings in this report show that poor financial wellbeing is a clear and present danger for employees, employers, the economy and society and that this problem is only going to get worse unless interested stakeholders take action. However, the potential opportunities from improved financial wellbeing are massive for workers, organisations, employers, the economy and society. HR has a key role to play in improving employee financial wellbeing and ensuring that their employers are able to build on this improvement through higher engagement, creativity and productivity.

FOR MORE INFORMATION

W: www.cipd.co.uk